Common Misconceptions About Travel Insurance

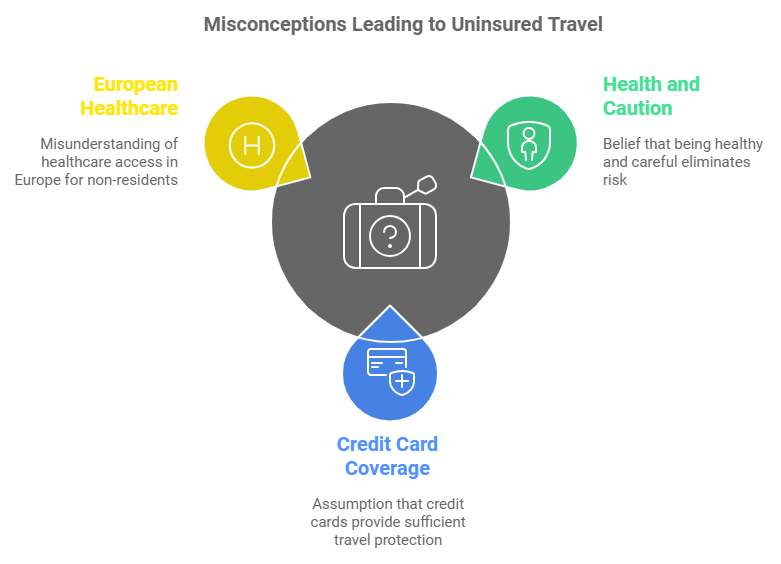

Many vacationers decide out of buying journey insurance coverage attributable to a number of misconceptions:

- “I’m Healthy and Careful”: Accidents and sicknesses can occur to anybody, no matter well being standing or warning.

- “My Credit Card Covers Me”: Credit card journey protections are sometimes restricted and will not cowl medical emergencies or journey cancellations comprehensively.

- “Europe Has Free Healthcare”: While some European nations supply sponsored healthcare, it’s usually just for residents or EU residents.

Medical Costs in Spain

Spain boasts a wonderful healthcare system, nevertheless it’s vital to notice that it’s not free for vacationers from non-EU nations.

Here’s a breakdown of potential medical prices you would possibly incur with out insurance coverage:

| Medical Service | Approximate Cost (EUR) |

|---|---|

| General Practitioner Visit | €100 – €150 |

| Emergency Room Visit | €200 – €400 |

| Hospital Stay (per day) | €600 – €800 |

| Surgery (e.g., Appendectomy) | €5,000 – €10,000 |

| Ambulance Transportation | €400 – €600 |

| Prescription Medication | €20 – €100 |

An sudden medical emergency can rapidly escalate into hundreds of euros in bills.

For instance, a easy fracture may require surgical procedure and a hospital keep, probably costing upwards of €7,000.

Other Risks While Traveling

Lost or Delayed Luggage

Luggage mishandling by airways is extra frequent than most individuals understand. In truth, in accordance with the SITA Baggage Report of 2022, round 4.35 baggage per 1,000 passengers had been mishandled globally in 2021.[/su_note]

While this will likely appear to be a small share, if you happen to’re the one standing on the baggage declare with out your suitcase, it might probably rapidly turn into a irritating and expensive expertise.

When your baggage is misplaced or delayed, you’re usually left to buy important gadgets resembling clothes, toiletries, and different private gadgets, which may add up. Travel insurance coverage might help by reimbursing you for these obligatory bills, assuaging a number of the stress and inconvenience.

Flight Cancellations and Delays

Flight disruptions are one of the frequent points vacationers face, whether or not it’s attributable to unhealthy climate, technical points, or overbooking.

Having a flight canceled or considerably delayed can derail your total journey itinerary. Without journey insurance coverage, you would possibly end up paying out of pocket for brand new flights, additional nights in accommodations, and meals when you look forward to the following out there flight.

These sudden bills can rapidly add up, notably if you happen to’re touring throughout peak occasions when flights and lodging could already be costly.

A complete journey insurance coverage coverage usually covers such conditions, making certain you possibly can rebook flights or lengthen your keep with out shouldering the complete monetary burden.

Theft and Pickpocketing

While Spain is mostly a secure nation for vacationers, sure cities, notably common ones like Barcelona and Madrid, have gained reputations as hotspots for pickpocketing. Public locations resembling crowded markets, public transportation, and vacationer points of interest are the place theft is probably to happen.

If your pockets, passport, or beneficial gadgets like electronics are stolen, the monetary and emotional toll could be appreciable.

You may have to switch vital paperwork like your passport, cancel bank cards, or purchase a brand new cellphone or digicam. Without insurance coverage, you’d be answerable for these prices.

Travel insurance coverage can cowl the theft of private belongings, offering reimbursement for misplaced gadgets and even serving to with the price of changing important paperwork like your passport.

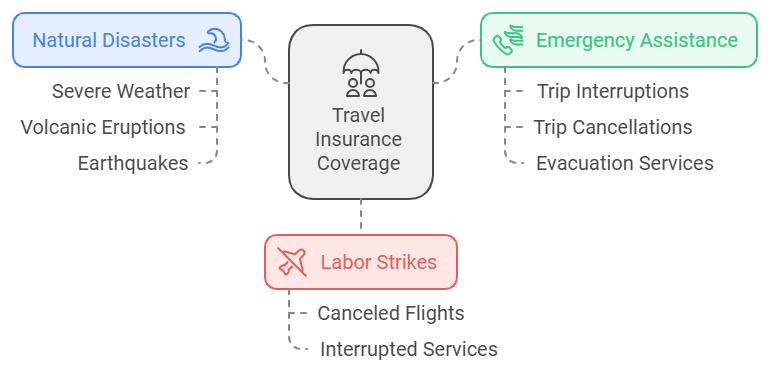

Natural Disasters and Strikes

Although uncommon, pure disasters or labor strikes can have a major impression on journey plans.

Events resembling extreme climate, volcanic eruptions, or earthquakes can disrupt flights, trigger evacuations, and even go away vacationers stranded. Similarly, airline or transportation strikes—frequent in lots of European nations—may end up in canceled flights or interrupted companies, forcing you to change your itinerary. In these conditions, journey insurance coverage could be a lifesaver.

Most complete insurance policies present protection for journey interruptions or cancellations brought on by such unexpected occasions. If evacuation is critical, some insurance policies additionally embody emergency help companies, making certain you obtain the required assist in a disaster.

Personal Accidents and Injuries

While having fun with the attractive landscapes and fascinating in adventurous actions in Spain, accidents can occur. Whether you’re mountain climbing within the mountains, biking across the countryside, or just exploring the streets of a bustling metropolis, you’re all the time vulnerable to harm.

In case of an accident that ends in medical consideration, an emergency evacuation, or hospitalization, the prices could be extraordinarily excessive, particularly for non-EU residents.

Without journey insurance coverage, you might find yourself going through huge out-of-pocket bills for medical remedy.

Even one thing so simple as a damaged leg or sprained ankle may end in important medical payments.

However, with satisfactory journey insurance coverage, your medical prices, together with remedy, hospital stays, and even medical evacuations, could be coated, supplying you with peace of thoughts.

Trip Cancellations Due to Illness or Emergency

Sometimes life throws sudden curveballs, and also you would possibly must cancel or minimize brief your journey attributable to sickness, harm, or household emergencies.

Without journey insurance coverage, non-refundable bookings—whether or not for flights, lodging, or actions—are usually misplaced, leaving you out-of-pocket.

Many journey insurance coverage insurance policies supply journey cancellation or interruption protection, which reimburses you for pay as you go, non-refundable bills if you have to cancel or shorten your journey attributable to a coated cause.

This could be particularly useful for costly worldwide journeys the place a sudden change in plans may result in substantial monetary losses.

Missed Connections

If you’re touring on a good schedule with a number of connecting flights, a missed connection can throw off your total itinerary.

Whether your preliminary flight is delayed or canceled, lacking a connecting flight may end up in having to rebook and probably pay for a brand new flight or lodge keep.

Without journey insurance coverage, these added prices can turn into a major burden.

Rental Car Accidents or Damage

Renting a automotive whereas exploring Spain is a well-liked alternative for a lot of vacationers, particularly these seeking to go to rural areas or discover the nation at their very own tempo.

However, accidents or injury to a rental automotive can result in pricey repairs and even authorized liabilities.

Even when you’ve got automotive insurance coverage at dwelling, it could not lengthen to worldwide leases.

Travel insurance coverage usually consists of protection for rental automotive injury, so in case your rental car is broken in an accident or vandalized, the coverage can cowl restore prices.

This safety ensures you’re not paying exorbitant charges for injury or accidents involving a rental automotive.

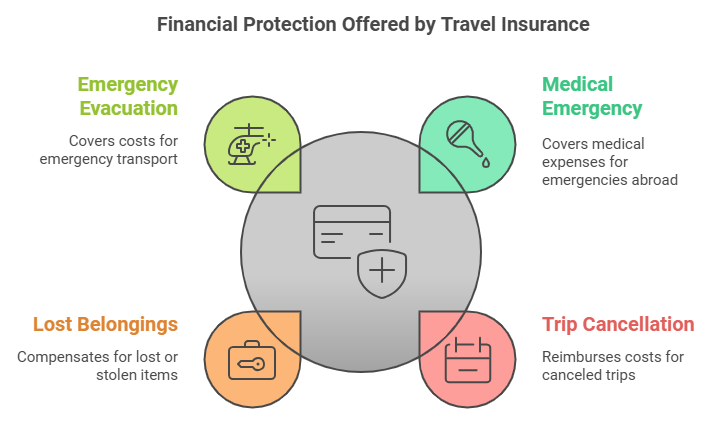

Cost of Travel Insurance vs. Potential Expenses

Investing in journey insurance coverage is comparatively cheap in comparison with the potential prices of sudden incidents.

Average Travel Insurance Costs for a Two-Week Trip to Spain

| Age Group | Policy Cost (USD) |

|---|---|

| 18-30 | $50 – $80 |

| 31-50 | $70 – $120 |

| 51-65 | $100 – $150 |

| 66+ | $150 – $250 |

Potential Out-of-Pocket Expenses Without Insurance

- Medical Emergency: €5,000 – €10,000

- Trip Cancellation: Up to the whole value of your journey

- Lost or Stolen Belongings: €1,000 – €3,000

- Emergency Evacuation: €20,000 – €50,000

By evaluating these figures, it’s evident that the price of journey insurance coverage is minimal in comparison with potential bills.

Legal Requirements and Schengen Visa Regulations

For vacationers from sure nations, acquiring a Schengen visa is a prerequisite for getting into Spain.

One of the necessities for a Schengen visa is proof of journey insurance coverage with a minimal protection of €30,000 for medical emergencies in accordance with AXA.

Even if you happen to’re from a rustic that doesn’t require a visa for Spain, the Schengen space’s insurance coverage suggestions spotlight the significance of being coated.