Claim to be verified: BlackRock presents its international purchasers sustainable funding merchandise, which allegedly exclude fossil fuels.

Context: In the primary quarter of 2025 solely, the world’s largest asset supervisor invested US$3 billion in fossil-fuel corporations by means of its funds outlined as sustainable. BlackRock promotes them with language that’s doubtlessly deceptive and prone to depart unwary traders believing that such merchandise exclude fossil fuels.

In 2016, Larry Fink, CEO of funding agency BlackRock, had no doubts concerning the significance of environmental, social, and governance (ESG): “Over the long run, ESG points – starting from local weather change to variety to board effectiveness – have actual and quantifiable monetary impacts”, he wrote in a letter on company governance in 2016.

The CEO of the world’s largest asset-management firm has since modified his thoughts: “The motive I backed away from utilizing the time period ESG is that it means one thing completely different to everybody. It’s so undefined that it is develop into unmentionable”, Fink stated in 2023, as a visitor on the Wall Street Journal podcast “Free Expression”. In the identical podcast, he added: “If you need to spend money on hydrocarbons, we are going to choose the very best hydrocarbon corporations on the earth for you. If you need to spend money on a extra decarbonized portfolio, we’ll attempt to discover the very best financial portfolio that may obtain your monetary objective.”

BlackRock manages US$11.6 trillion of investments. The agency has drastically modified its ESG and sustainable-investing insurance policies lately. In its 2020 letter to purchasers, BlackRock used the time period “ESG” 26 occasions and made a daring assertion: “We imagine that sustainability should develop into our new normal for investing.” It additionally pledged to launch a product “that permits purchasers to spend money on corporations with the best ESG scores, utilizing our most in depth exclusion standards, together with one for fossil fuels.”

These commitments have been extensively coated within the worldwide media. In January 2020, the specialist journal UK Investor headlined: “BlackRock to deal with ESG and local weather change in 2020”. CNBC wrote: “BlackRock, a $7 trillion asset supervisor, places local weather change on the coronary heart of its funding technique for 2021.” The specialist publication ESG Today requested: “BlackRock is betting every little thing on sustainability: Why is that this vital?”

| Glossary |

| The European Regulation on sustainability-related disclosures within the monetary companies sector (generally known as SFDR) introduces two classes of inexperienced investments: people who merely promote “environmental and/or social traits” (Article 8), identified within the jargon as “gentle inexperienced”, and people who should be correctly “sustainable” (Article 9), generally known as “darkish inexperienced”. In each instances, sure extra particulars should be offered to the buyer/investor, particularly: (1) details about how these traits are met and (2) if a benchmark is indicated, an evidence of how that benchmark is in keeping with the marketed traits.

While asset managers can independently outline the factors by which they take into account a fund to advertise “environmental and/or social traits”, “Article 9” funds should meet extra stringent standards concerning renewable vitality, greenhouse fuel emissions, and many others. However, by exploiting semantic ambiguities, some managers nonetheless select to promote funds that don’t fall underneath Article 9 however reasonably underneath Article 8, whereas nonetheless labelling them as “sustainable and accountable” (i.e. darkish inexperienced) investments. |

To stick with the playing theme, was BlackRock bluffing? In its 2025 letter, there isn’t any reference to sustainability, ESG, or the Paris Climate Agreement. The firm has left Net Zero Asset Managers, a world initiative launched in 2020 to advertise net-zero 2050 tasks. Following the departure of different main gamers corresponding to JP Morgan, Net Zero Asset Managers has suspended its actions.

Yet, however the ESG labels, the local weather guarantees, and the pledges of “sustainability”, BlackRock continues to supply merchandise that funnel cash to the hydrocarbons giants.

BlackRock’s “sustainable” investments in fossil fuels

From 2023 to 2025, BlackRock invested an annual common of US$2.3 billion within the fossil-fuel majors by means of its ESG funds. The supposedly “inexperienced” funds we initially recognized are people who make reference to the EU Sustainable Finance Regulation (SFDR), which got here into drive in 2021. Articles 8 and 9 of the SFDR concern the promotion of “environmental or social” goals and “sustainable investments”, respectively.

In markets the place sustainable finance will not be regulated, BlackRock promotes funds which can be completely outdoors the SFDR definitions as “ESG”, “sustainable” and (vitality) “transition”. These amounted to US$1.8 billion within the first quarter of 2025. The incontrovertible fact that sustainable finance is sort of wholly unregulated in international locations such because the United States permits BlackRock to make use of notably audacious names for merchandise which proceed to channel cash to Big Oil. Examples embody “iShares ESG Aware”, “iShares Global Clean Energy”, and “BlackRock Sustainable Advantage”.

A US investor would possibly thus be bought a BlackRock “Carbon Transition Readiness” fund that has funnelled greater than ten million {dollars} to fossil giants together with BP, Equinor, Shell, Eni, and TotalEnergies. The “Climate Conscious and Transition” fund, in the meantime, has pumped US$65 million into Chevron, ConocoPhillips, EOG, Exxon, and Occidental Petroleum.

Among the so-called “carbon majors” during which BlackRock invests by means of its supposedly inexperienced funds are most of the identical names: TotalEnergies, Shell, Equinor, Chevron, Eni, and Repsol. All are heavy emitters of greenhouse gases chargeable for international warming. None, as we confirmed within the earlier article on this collection, is at present on observe with its Paris Agreement targets.

BlackRock seems to be disrespecting its personal standards

Contrary to Larry Fink’s statements within the Wall Street Journal podcast, our fact-checking reveals that over 20 funds categorised as Article 8 or 9 (the “inexperienced” fund classes underneath EU rules) have stakes within the oil giants. This even though their prospectuses comprise commitments on ESG or decarbonisations, and should even overtly surrender fossil-fuel investments.

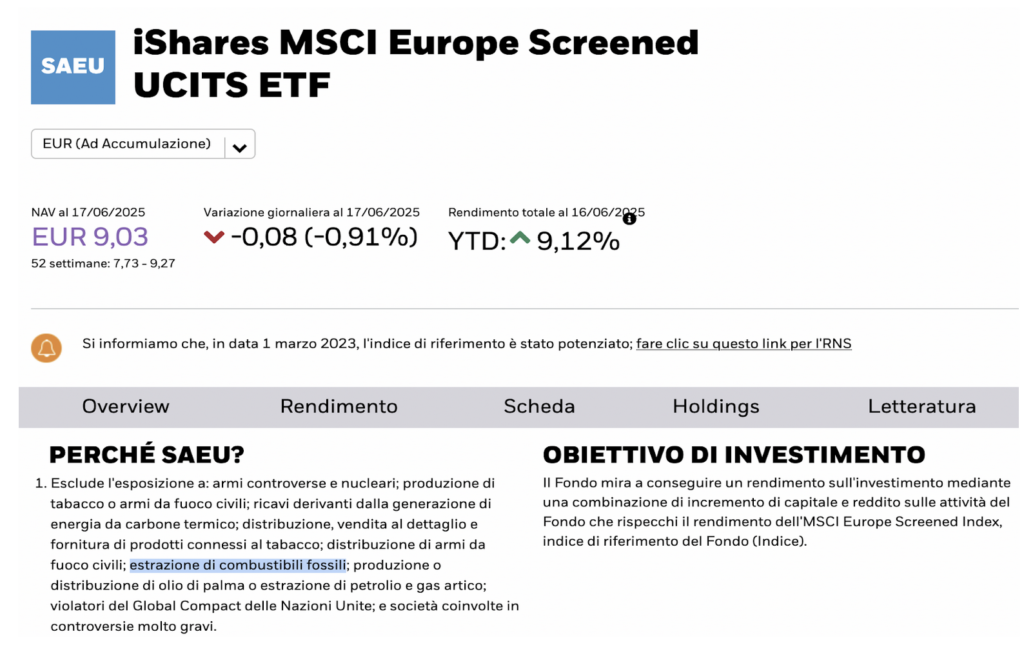

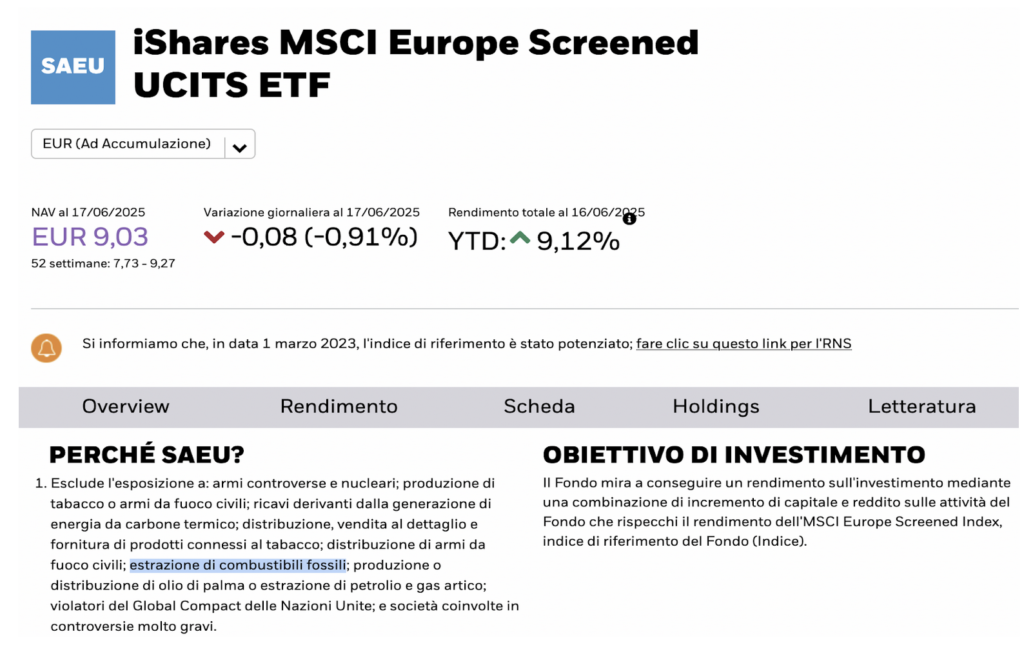

For instance, the iShares MSCI Europe Screened UCITS ETF (exchange-traded fund) explicitly states within the first strains of its description that it excludes publicity to “fossil-fuel extraction”. A BlackRock shopper who will not be sufficiently versed in decoding such claims would possibly subsequently fairly anticipate corporations corresponding to Shell, TotalEnergies, and Eni to be excluded.

A better have a look at the fund’s sustainability data reveals that it’s passively managed and follows the MSCI Europe Screened Index, aiming to advertise environmental and social requirements. This means the fund makes use of MSCI’s personal guidelines for excluding sure corporations — MSCI being one of many largest international monetary companies.

To perceive what these exclusion guidelines are, traders should go to MSCI’s web site and browse the ESG (Environmental, Social and Governance) methodology behind the index. While it initially seems that oil and fuel are excluded, the detailed guidelines reveal in any other case. The index doesn’t exclude all fossil gas corporations. Instead, it solely leaves out these incomes greater than 5% of their income from particular controversial sources: coal, unconventional oil and fuel (like fracking or tar sands), palm oil, Arctic drilling, or corporations that violate the UN Global Compact’s voluntary sustainability ideas.

In quick, the index permits most fossil gas corporations until they cross sure thresholds. That’s why BlackRock, which makes use of this index, can declare in its prospectus to exclude fossil gas extraction — however then make clear in different paperwork that it depends on MSCI’s standards. In truth, BlackRock refers readers to MSCI’s methodology web page for particulars — however that web page results in a 404 error.

This index, like many others we examined, claims to exclude corporations concerned in hydrocarbon extraction. However, it later clarifies that the exclusion applies solely to “unconventional” tasks, corresponding to tar sands and Arctic drilling.

Despite this, most of the corporations the funds spend money on are nonetheless concerned in these very actions. An in depth have a look at the principles and factsheets reveals that there’s usually flexibility underneath obscure classes like “different investments.” This loophole permits the funds to legally preserve their “sustainable” label, even whereas investing in corporations that contradict it.

Receive the very best of European journalism straight to your inbox each Thursday

In its sustainability report, in the meantime, BlackRock makes a complicated declare that may elevate eyebrows among the many extra attentive purchasers: “This Fund promotes environmental or social traits, however doesn’t intention to take a position sustainably.” The assertion appears to battle with the very description of the funding, which talks of “a significant strategy” to sustainable investing.

To additional defend itself, BlackRock makes clear that any sustainability circumstances “don’t change a fund’s funding goal or restrict its funding universe, and there’s no indication {that a} fund will undertake funding methods centered on ESG components, affect, or exclusion standards”. BlackRock thus successfully contradicts its personal promise to exclude fossil fuels.

In the primary quarter of 2025, such nominally “inexperienced” funds held fossil-fuel property value greater than US$1 billion.

Reviewing our findings, Nicolas Koch, from the NGO Sustainable Finance Observatory, feedback: “We can not anticipate clients to learn all the knowledge, and it’s seemingly that almost all of them will likely be simply misled by statements that sure actions are utterly excluded, when the truth is they don’t seem to be. However, the SFDR represents a significant victory when it comes to transparency on this regard. It ought to present the mandatory data to intermediaries, corresponding to monetary advisors, who may simply exclude this fund because of the SFDR.”

In its “inexperienced” funds that particularly declare to exclude hydrocarbons from their portfolios, BlackRock holds fossil-fuel investments value a complete of US$850 million. The first strains of their prospectuses, along with mentioning the exclusion standards, state that the investments are designed to scale back carbon impacts.

In August 2024, the European Securities and Markets Authority (ESMA) launched stricter guidelines on using sustainability-related phrases in fund names. These guidelines prohibit funds with vital fossil gas holdings from utilizing labels like “inexperienced,” “ESG,” or “sustainable.” The regulation took impact on 21 May 2025.

Before that date, the iShares MSCI Europe Screened UCITS ETF included “ESG” in its identify, regardless of holding US$177 million in fossil gas corporations. As of now, it nonetheless holds round US$156 million in companies like Shell, TotalEnergies, Eni, Equinor, EQT, Aker, and OMV. Yet, the fund claims it’s designed for traders who need to “exclude controversial sectors and cut back carbon depth.”

In the primary quarter of 2025, the iShares MSCI EMU ESG Enhanced CTB UCITS ETF fund invested US$160 million in fossil-fuel property. It carries the CTB label, referring to the Carbon Transition Benchmark, which means that it ought to promote decarbonisation requirements. According to the brand new tips of the ESMA, BlackRock is required to reveal in its sustainability reporting how its investments are “on a transparent and measurable path in the direction of social or environmental transition”.

In its sustainability disclosures, BlackRock states that it does not practise “engagement” with corporations. The time period refers back to the interplay between asset managers and firms during which they maintain fairness stakes by means of “inexperienced” funds, the place the intention is to positively affect their ESG and local weather insurance policies. According to a report by the European Commission’s sustainable-finance platform, such engagement can have constructive impacts on corporations, and this must be measured and shared with purchasers. BlackRock has chosen a unique path. According to its disclosures, it “doesn’t immediately have interaction with corporations, focusing as an alternative on the standard of ESG knowledge (it’s dedicated to partaking immediately with knowledge and index suppliers to make sure higher evaluation and stability of ESG metrics)”.

“This will not be a great way to generate affect and supply a extra decarbonised funding portfolio”, says Sustainable Finance Observatory’s Nicolas Koch. NGO ShareAction’s newest report reveals that BlackRock has lowered its assist for ESG resolutions at shareholder conferences to virtually zero %, and its dedication to sustainability will not be enough to be thought of credible. “Therefore, for any impact-oriented retail investor who has bought iShares ESG ETFs up to now or is contemplating buying them sooner or later, there’s a clear advice: keep away from these merchandise and transfer towards funds that have interaction in credible dialogue with corporations”, concludes Koch.

To date, not one of the carbon majors, together with these during which BlackRock’s inexperienced funds make investments, seem to have energy-transition plans in keeping with worldwide local weather targets

Robert Clarke, an skilled at Client Earth, a nonprofit authorized and environmental organisation, makes an identical level:

“There is a large query mark over affect claims. This is one other class of potential ‘transition-washing’. Many funds have been rebranded from ‘ESG’ or ‘sustainable’ to ‘transition funds’, highlighting a subset of them that target transition methods. But the issue right here is: what occurs if a fund is labeled a transition fund however the investments usually are not constant? An instance of this, in our view, is sustained funding within the enlargement of fossil fuels, which is just incompatible with the transition.”

To date, not one of the carbon majors, together with these during which BlackRock’s inexperienced funds make investments, seem to have energy-transition plans in keeping with worldwide local weather targets. In truth, many appear to have watered down their local weather methods over the previous yr, as reported in a Carbon Tracker report revealed in April 2025.

Specialists agree that engagement with corporations and voting at shareholder conferences are the simplest mechanisms for guaranteeing that “sustainable” investments have an effect. A latest report by the Sustainable Finance Observatory reveals that 51 % of European traders need their investments to have an effect.

We requested ESMA whether or not it considers BlackRock’s statements on sustainability to be contradictory. “The supervisory authority of the associated fund should decide whether or not it intends to research whether or not the disclosure could also be unclear, incorrect, or deceptive to traders”, a spokesperson stated.

“BlackRock operates in some of the extremely regulated industries on the earth, and our funds, their prospectuses, and their supporting paperwork, adhere to all relevant rules,” a spokesperson for the financial institution advised Voxeurop. He added: “For our sustainable vary, this contains these governing sustainable investing. iShares ETF holdings are revealed each day to offer traders with full transparency into the place their investments go, and our main sustainable fund vary presents a spectrum of exposures permitting our purchasers to decide on the right way to meet their very own particular person funding targets.”

BlackRock accused of greenwashing by Client Earth

The apparent incompatibility between the names of “sustainable” funds and their Big Carbon investments was tackled head on by the environmental group Client Earth in October 2024.

The organisation filed a authorized criticism with the French monetary supervisory authority, the AMF, difficult BlackRock’s labelling of sure consumer-oriented funds as “sustainable”. It singled out merchandise such because the BSF Systematic Sustainable Global Equity Fund, declaring that such funds had channelled €1 billion to the fossil-fuel sector.

In its motion, Client Earth argued that such labels mislead customers and should violate EU rules. “There are guidelines that require communications to be honest, clear, and never deceptive”, stated Robert Clarke. “It must be the duty of the regulatory authorities [of the country] the place the funds are marketed to take motion to fight greenwashing, not solely in fund names but in addition in prospectuses, with the intention to defend their funding sector. At current, nationwide authorities are failing to take motion.” In the wake of the criticism, BlackRock has modified the names or exclusion standards of a number of of its funds.

🤝 This article is revealed in collaboration with IrpiMedia; it’s a part of Voxeurop‘s investigation into inexperienced finance and was produced with the assist of the European Media Information Fund (EMIF)

The sole duty for any content material supported by the European Media and Information Fund lies with the writer(s) and it might not essentially mirror the positions of the EMIF and the Fund Partners, the Calouste Gulbenkian Foundation and the European University Institute.