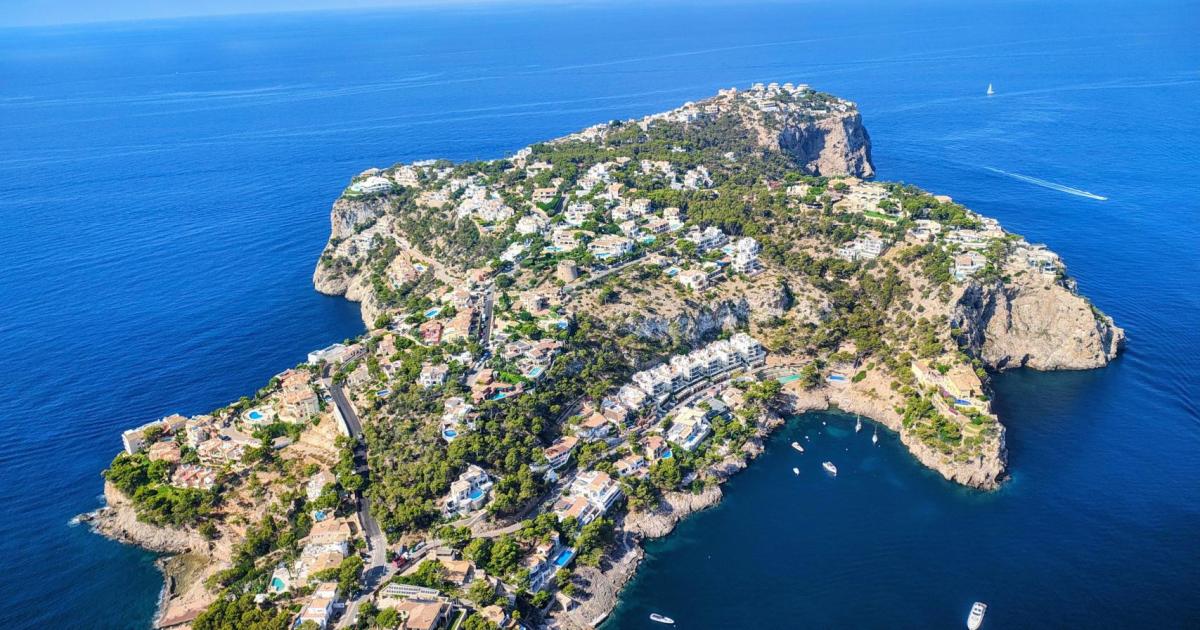

In May, the Spanish authorities introduced it was pushing forward with a 100 per cent gross sales tax on dwelling purchases by non-resident/non European Union residents in a controversial transfer which might hit the sale of vacation properties to hundreds of British, North American and different third-country non-EU residents. The tax is aimed toward cooling Spain’s booming property market which has left hundreds of thousands of Spaniards being unable to purchase a house. Foreign patrons are being blamed. The tax is nationwide.

A invoice was offered to the Spanish parliament by Prime Minister Pedro Sánchez, in search of to advertise “measures that allow entry to housing, since we face one of many largest issues our society is at the moment confronted with”. And now, cash-strapped European governments trying to tax the wealthy more durable to plug holes in public funds and redress rising inequality could discover that direct wealth levies will not be the simplest resolution.

History exhibits outright wealth taxes hardly ever generate a lot income and sometimes miss their principal targets, tax specialists and economists say. They level to a menu of choices that work higher, together with better scrutiny of capital good points, inheritance taxes and exit charges for these attempting to modify to a tax haven.

“Concerns about wealth inequality don’t suggest that governments ought to use web wealth taxes,” the IMF mentioned in a latest information to governments. “Improving capital revenue taxes tends to be each extra equitable and extra environment friendly.

In Europe, Switzerland, Spain and Norway have various types of a wealth tax on holders of property above a sure degree, and France and Britain are debating the concept to cut back their price range deficits.

The common high revenue tax fee throughout the 38 nations within the Organisation for Economic Co-operation and Development fell from 66% in 1980 to 43% at the moment.

And on the very pinnacle of society, the highest 0.0001% of earners will pay hardly any taxes in any respect in nations corresponding to France and the Netherlands as a result of they will park their property in holding firms, in keeping with analysis by Paris School of Economics professor Gabriel Zucman. He was behind a proposal for a 2% wealth tax on France’s richest 0.01% within the 2026 price range, now being debated by politicians.

“We want to make sure that billionaires pay at the very least as a lot as different social teams,” Zucman instructed Reuters. “It is a fundamental query of justice and respect for the elemental rules of tax equity.”

But taxing an individual’s inventory of property isn’t the one or maybe even one of the simplest ways to get there. These taxes usually generate modest revenues of just some decimal factors of gross home product. This is as a result of taxpayers, notably the ultra-rich, can simply protect their property by inserting them in companies or trusts, in exempted or hard-to-value objects corresponding to antiques, and even siphon them off to tax havens.

In addition, a wealth tax is usually levied on all sorts of wealth on the identical fee – successfully penalising those that personal lower-yielding property. By distinction, a tax on the revenue derived from capital – corresponding to dividends and capital good points, that are earnings made when an asset is bought – is levied on precise returns. As these are typically topic to decrease tax than labour revenue, proponents of taxes on the rich see room for change.

“The beneficial tax remedy of good points is a major driver of low efficient tax charges amongst high-net-worth people,“ the OECD mentioned in a report revealed earlier this yr. Income from capital good points and dividends is taxed at a low, flat fee in nations together with France, Germany, Italy, South Korea and Japan. Some economists argue low taxes on capital encourage financial savings, funding and entrepreneurship, though OECD analysis exhibits these goals might be achieved in different methods, corresponding to focused reduction.

Fixes embrace eradicating exemptions for capital good points, corresponding to on some actual property, and ensuring these are taxed, on the newest, when property are inherited or a taxpayer leaves the nation, particularly for a tax haven, in keeping with OECD and IMF analysis. Inheritance tax, generally disparagingly known as a “loss of life tax”, is each truthful and environment friendly, in keeping with the OECD.

Its researchers argue it has benefits over a wealth tax, corresponding to not discouraging folks from saving for his or her previous age or, if the precise exemptions are in place, from making a nest for his or her youngsters. Detractors say inherited property have already been taxed when revenue was earned. They level to the truth that the highest 1% of earners are already the most important contributor to the state’s coffers in most main nations.

While most developed economies do tax inherited wealth, not all make full use of that software.

Most don’t tax unrealised capital good points, and supply beneficiant allowances for enterprise property.

In Italy, Poland and, as much as a threshold, South Korea, heirs don’t pay any levy on a enterprise they inherit. In Ireland, Spain and Germany there are very excessive exemptions.

In a aggressive world surroundings, policymakers have to strike a stability in elevating tax income with out sending the rich to different jurisdictions, tax specialists say. Yet tax activist group the Tax Justice Network argues everybody would profit from a narrower wealth hole. “One of the issues that undermines social outcomes for everyone, together with the wealthiest, is inequality… High inequalities undermine financial progress. They undermine life expectancy throughout the board,” mentioned the Tax Justice Network’s Chief Executive Alex Cobham.